The House That Defies Billionaire Logic

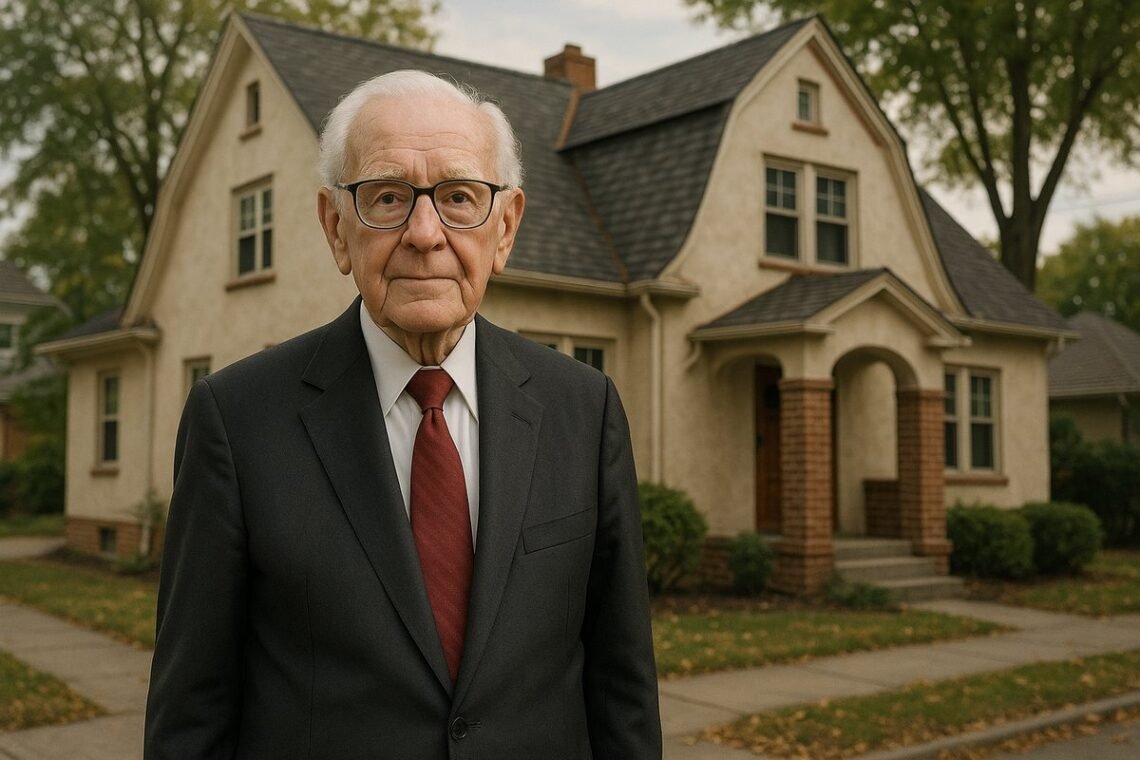

In a world where billionaires often collect mega-mansions like trading cards, Warren Buffett stands apart. With a net worth soaring past $100 billion, the legendary investor could own any property he desires. Yet, for over six decades, he has chosen to live in a modest stucco house in Omaha, Nebraska.

He purchased the home in 1958 for just $31,500, a figure that seems almost unbelievable today. This simple housing choice offers a profound glimpse into the mind of the man known as the Oracle of Omaha. It challenges our very definition of wealth and happiness.

A Corner Lot in Omaha: The Property Details

The now-famous Warren Buffett house sits on a quiet corner lot at 5505 Farnam Street. Built in 1921, the 6,570-square-foot home is a fine example of Dutch Colonial architecture. The structure combines brick and stucco, creating a warm and inviting exterior. While certainly comfortable, it is far from extravagant by billionaire standards.

The house features five bedrooms, multiple bathrooms, and a third-floor recreation space that previous owners once finished with a log cabin aesthetic. The property also includes a two-car garage and a basement complete with a wine cellar and laundry room. It’s a practical, family-oriented home, not a palace. This reflects the grounded nature of its owner.

Location and Convenience

The house sits just five minutes from Berkshire Hathaway’s corporate headquarters. This proximity has allowed Buffett to maintain his famously simple commute. No limos, no helicopters, just a short drive to the office where he has built one of the most successful investment companies in history.

From $31,500 to $1.5 Million: The Numbers Behind the Investment

When a 28-year-old Warren Buffett bought his home, it was a significant but sensible purchase. He and his then-wife Susan were raising three young children and needed a stable place to call home. The decision came after careful consideration. They debated whether to spend their savings on a house or invest the money elsewhere.

Today, that same property is valued between $1.2 and $1.5 million. This represents a nearly 4,700% return on his initial investment. The appreciation has outpaced the broader U.S. housing market, where median home prices increased roughly 23-fold during the same period.

However, Buffett himself has noted that he could have earned more by renting and investing the difference in stocks. For him, the house was never just about the numbers. It was about creating a stable and happy life for his family. That’s a calculation that goes beyond spreadsheets.

Why Warren Buffett Never Moved

So, why has a man who could afford a private island remained in the same house for over 65 years? The answer lies in his deeply rooted philosophy of life. “I’m happy there. I’d move if I thought I’d be happier someplace else,” he once explained in an interview.

He famously stated that “possessions possess you at a point,” a belief that has guided his decisions for decades. The Omaha house is convenient, comfortable, and filled with memories. For Buffett, it is the embodiment of home, a place of contentment that no amount of money could replace.

He has even called it his third-best investment, surpassed only by his wedding rings. That statement reveals something essential about his character. The best investments aren’t always measured in dollars. Sometimes they’re measured in years of happiness and stability.

A Philosophy of Contentment

Buffett’s approach to housing mirrors his investment strategy. He looks for value, not flash. He thinks long-term, not about impressing neighbors. This consistency between his personal life and professional philosophy is rare among the ultra-wealthy. It’s also what makes his story so compelling.

The Frugal Lifestyle of a Financial Titan

Buffett’s housing choice is not an isolated quirk. It is a cornerstone of his famously frugal lifestyle. This is a man who, until recently, used a simple flip phone despite Apple being one of Berkshire Hathaway’s largest holdings. He famously starts his day with a McDonald’s breakfast that never costs more than a few dollars.

His order often depends on how the stock market is performing that morning. When the market is down, he opts for the $2.95 sausage, egg, and cheese instead of the $3.17 bacon, egg, and cheese. It’s a small gesture, but it speaks volumes about his mindset.

This value-driven approach permeates every aspect of his life. From his personal spending to his multi-billion-dollar investments, the principle remains the same. It is a testament to his belief that true wealth is not about what you spend, but about what you value.

A House with History: Previous Owners and Legacy

Long before it became known as the Warren Buffett house, 5505 Farnam Street had a rich history of its own. Built in 1922 by real estate developer George H. Payne for $25,000, the house was designed by architect Charles Steinbaugh. Payne was a significant figure in Omaha’s development, having established a real estate company and later the Payne Investment Company.

The house later became home to Billy Nesselhous, who purchased it for his mother Martha Withnell for a substantial $75,000. Nesselhous was a former jockey and a key player in Tom Dennison’s political machine that dominated Omaha politics for nearly three decades. The house was often referred to as one of the city’s most beautiful properties during that era.

Another notable owner was Sam Reynolds, vice president and general manager of the Reynolds Updike Coal Company. He was later appointed to the U.S. Senate in 1954 to complete Hugh Butler’s term after his death. When Buffett purchased the house in 1957, he was not just buying a property. He was acquiring a piece of Omaha’s history, a legacy he has now extended for over half a century.

Lessons from Warren Buffett’s Housing Choice

In the end, Warren Buffett’s house is more than just a place to live. It is a powerful lesson in financial wisdom and life philosophy. It teaches us that value is more important than status. Long-term thinking trumps short-term trends. True happiness is not found in material possessions.

His life demonstrates that it is possible to be incredibly wealthy without being extravagant. The best investments are often the ones that provide not just financial returns, but a lifetime of joy and contentment. It is a message that resonates now more than ever.

In an age of social media flexing and conspicuous consumption, Buffett’s modest home stands as a quiet rebellion. It reminds us to focus on what truly matters. Sometimes, the smartest investment you can make is in a place that simply feels like home.